It’s every hiring manager’s nightmare. You hire a candidate who seems like a great fit. You’re confident this person will make a difference in their role, and you even see advancement potential. Except that it’s all a lie.

You find out, to your great embarrassment, that the employee is not who they seemed to be. Perhaps they lied about a degree. Or worse, maybe they get caught committing fraud in their role and damage the company for years to come. What is the cost of employee fraud, and how can you prevent it from happening? Here’s what you need to know.

What are the common types of employee fraud?

Employee fraud is an incredibly expensive liability. One of the reasons it’s hard to detect is that there are so many types of it. The most common is known as asset misappropriation, which is a broad term that covers many types of employee theft. Everything from check forgery to stealing inventory, misusing company services, worker’s compensation fraud, and more are included.

The second most common is payroll fraud. There may be a ghost employee getting paid, and the money is going to the fraudster. Timesheets can be falsified. Or, paychecks can be outright stolen from other staff.

Other types of fraud include vendor fraud, accounting fraud, and data theft.

Vendor fraud happens when employees work with vendors to take money or inventory from your company. Accounting fraud is when someone who controls funds misuses them for their own gain. Data theft involves taking proprietary information and using it for the fraudster’s gain. This can include anything from selling credit card numbers to stealing a restaurant’s essential recipes.

The cost of fraud

Most companies look at the immediate loss as the cost of fraud. The money stolen, inventory lost, or customers that were impacted are an essential part of the damage. However, it may be the smallest portion.

Fraud also causes you to have to fire and rehire an employee, which is a long and expensive process itself. It can affect the morale in the department that was affected. If the fraud becomes public, it can also impact the reputation of your business.

Worst of all, it can put the idea in other employees’ minds that they, too, can profit through fraud.

How do you detect fraud?

It’s essential to have controls in place to monitor all employees, even senior staff and trusted leaders. Small businesses are more likely to be victimized because they have fewer redundancies and monitoring plans.

However, large businesses are far from immune, especially since problems can fly under the radar for a long time in a busy company.

The other essential thing is to make sure you carefully check the background of each new hire. If you can prevent the hiring of bad apples, you can avoid a lot of fraud.

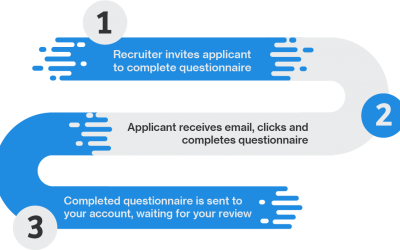

As a hiring manager, you may wonder where to get the time to be thorough on everyone. Fortunately, there are tools you can use to streamline the process. Hiringcue.com allows you to easily check references quickly rather than playing phone tag for days. You could choose to use an automated pre-screening questionnaire from Hiringcue.com as well. You have the option to choose from hundreds of existing questions or to create your own.

With a less time-consuming and more cost-effective process, you can know exactly who you’re hiring and avoid those who are likely to commit fraud.

Protect your business with strong hiring policies

As an HR leader, you’re the first line of defense when it comes to protecting your company from employee fraud. When you hire the right staff quickly and efficiently, you won’t have to deal with the nightmare of a terrible – or criminal – employee in your organization.

You need to cover the basics, like making sure they attended the schools they claim they did. You need to know they held the previous jobs listed. And most of all, you need to be aware of any past problems or poor references.

With Hiringcue.com, you can take care of all of this quickly and easily. In 60 seconds, you can send your reference request to the applicant. They fill out their reference information, and the reference sources receive an immediate invitation.

References are anonymous to encourage honest answers. You’ll get a clear idea of your applicant’s skills, knowledge, and abilities in the report you receive.

Ready to get started? Register today for a free trial and get the peace of mind you deserve in your hiring process.

Gary Kirksey

CEO

The Latest Articles

Steps to Prepare for the Next Wave of Hiring

Steps to Prepare for the Next Wave of Hiring As the COVID-19 pandemic begins to lift, states are re-opening and businesses are looking for employees. Whether you had to lay off staff, fired employees because you couldn’t operate, or need new talent, there’s about to...

Why Automated Reference Checks are the New Way Forward

According to a CareerBuilder survey, 58% of employers have caught a lie on a resume. The most common lies are embellishing skill sets and previous responsibilities. One of the most memorable noted in the survey was this: The applicant claimed to have been a...

When Normal Recruiting Returns, Will You Be Ready?

When Normal Recruiting Returns, Will You Be Ready? COVID-19 has caused us all to hunker down – physically in our homes, and financially with our businesses. 30 million Americans have filed initial unemployment claims since mid-March. More people than ever are looking...

0 Comments